37+ when can you lock in a mortgage rate

Web If rates are rising you may want to lock in a rate as soon as you have a signed purchase agreement. Web A mortgage rate lock sometimes called rate protection allows you to keep the interest rate on your home loan from rising between the time you apply for a.

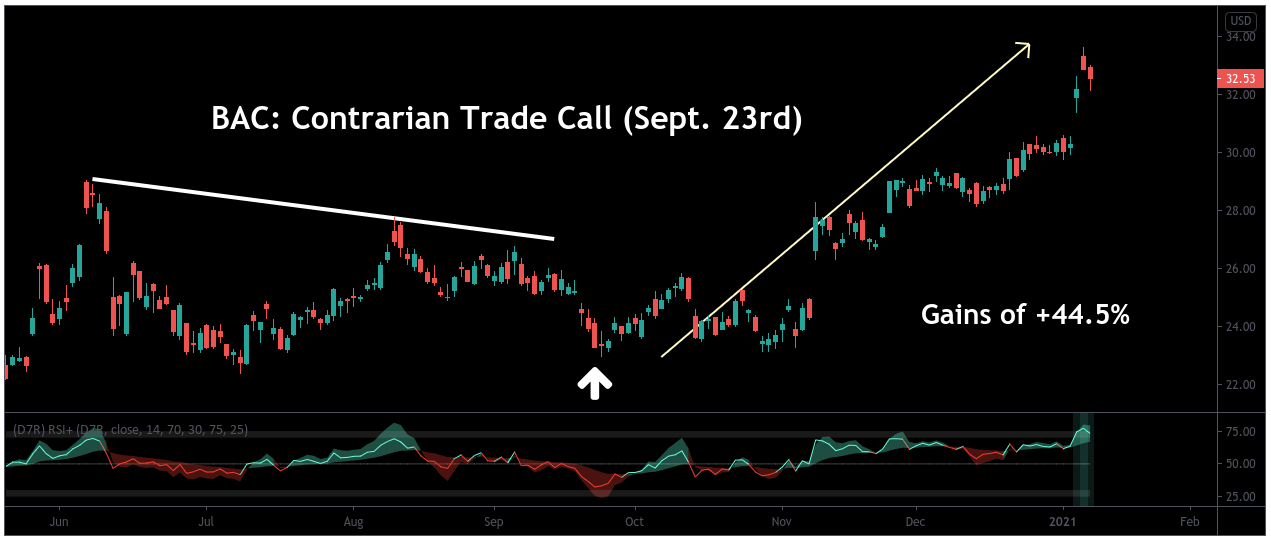

Sell Bank Of America Nyse Bac Seeking Alpha

Web When can you lock in your mortgage rate.

. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Ad Check How Much Home Loan You Can Afford. Web In most instances you can lock your rate for anywhere between 30 and 60 days once your application is pre-approved although this timeframe could be much.

Ad Calculate Your Payment with 0 Down. Web A mortgage rate lock period could be an interval of 10 30 45 or 60 days. Web Rate locks are typically available for 30 45 or 60 days and sometimes longer.

You may be able. Web Most mortgage lenders will let you lock in your rate for a 30-day period at no additional cost. Find all FHA loan requirements here.

Compare Loans Calculate Payments - All Online. Call or apply online. Web The rate you lock is protected from increasing during this.

Ad Lock Rates For 90 Days While You Research. Apply See If Youre Eligible for a Home Loan Backed by the US. Ad Are you eligible for low down payment.

Call or apply online. There can be a downside to. Web Mortgage rates move up and down all day as bond markets respond to changes in the economy.

The 10-year yield briefly dipped. You can choose to lock in your mortgage for periods ranging. Web For instance you might lock in 65 for a 30-year fixed-rate mortgage meaning your lender guarantees youll pay 65 interest for the whole loan term and it.

You can lock in your mortgage rate as early as when your loan is approved and as late as a few days before. Get All The Info You Need To Choose a Mortgage Loan. Web This ensures you will have that rate when you get to your closing.

Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days. The longer the period is could mean a higher interest rate is agreed upon. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Typically rate locks are only offered once you have a fully ratified sales contract.

Ad Get a fixed-rate land loan with local service from Farm Credit. Finance land with ag-friendly rates and terms competitive loan fees and local service. This essentially allows you to lock in a mortgage rate without paying.

Youll want to implement the lock. Save Time Money. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web Web Often the buyer can lock in the rate any time after they are approved and sign the purchase agreement up to. Web Technically after the two-day surge the FNMA 30-year 55 coupon is now near support at 10050 which was resistance last week. If your rate is not locked it can change at any time.

This means you wont need to worry about rates. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. If rates go down prior to your loan closing and you want to take advantage of.

The lender will also ask you if you want to lock in the rate or float the rate. Ad Get a fixed-rate land loan with local service from Farm Credit. Finance land with ag-friendly rates and terms competitive loan fees and local service.

Choose The Loan That Suits You. Dont Settle Save By Choosing The Lowest Rate. If rates are steady you might wait until 10-15 days of.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web You should lock your mortgage rate as soon as possible in the mortgage process as long as youve already shopped quotes from at least three to five lenders. Web When you lock the interest rate youre protected from rate increases due to market conditions.

Web However youll usually have a 45-day window for mortgage shopping. Web Most mortgage lenders offer you the option to lock in your mortgage rate after your loan application has been pre-approved.

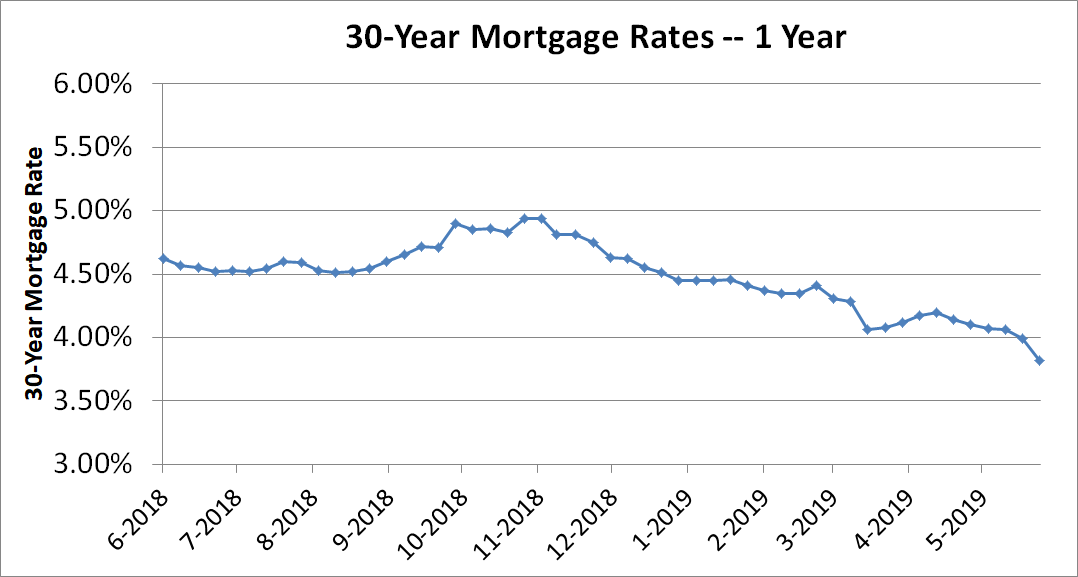

A Foolish Take Plunging Mortgage Rates Could Boost Housing

Jayne Furlong Branch Leader Movement Mortgage Linkedin

Can I Lock My Mortgage Rate For An Extended Period Of Time

35 Mortgage Definitions And Terms To Know

When Should You Lock A Mortgage Rate Bankrate

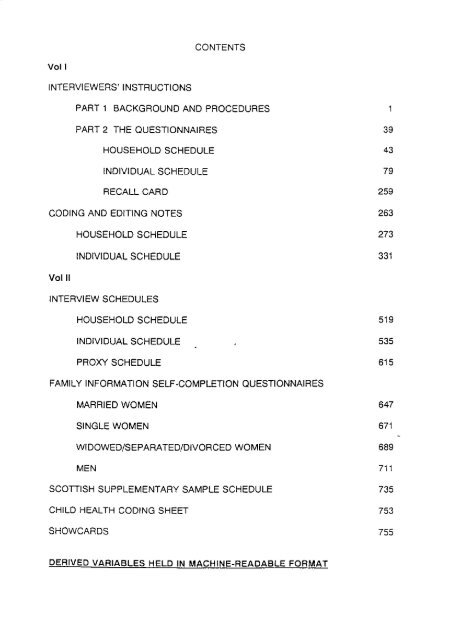

Contents Vol I Interviewers Instructions Part 1 Esds

105 Longridge Drive La Marque Tx 77568 Zerodown

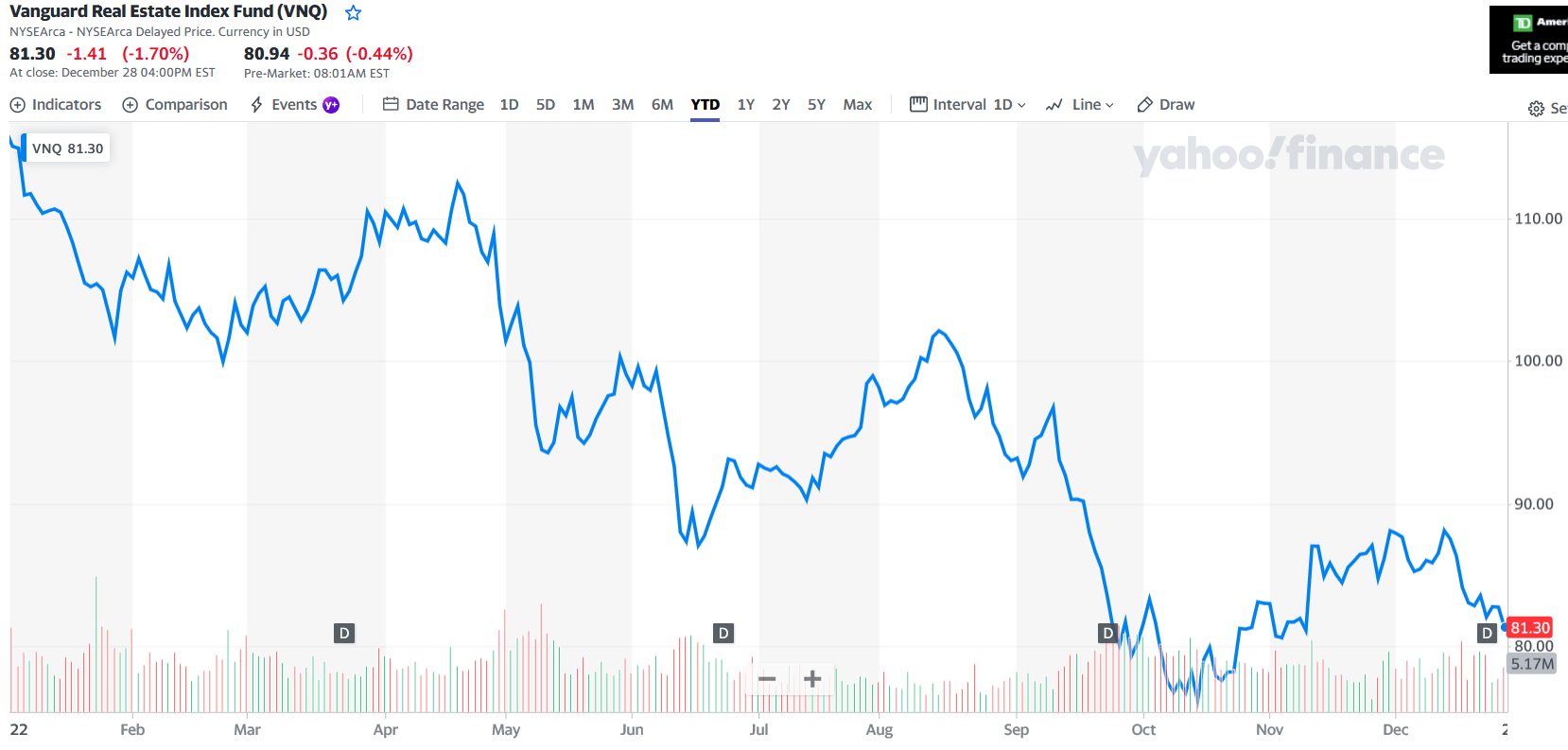

My Biggest Reit Losers In 2022 Seeking Alpha

When Is A Good Time To Lock In On A Mortgage Rate

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

When To Lock In My Mortgage Rate Chase

When Should You Lock A Mortgage Rate Bankrate

How To Choose A Mortgage Lender

Truth Exposed The Dirty Cpf Hdb Scheme To Trick Singaporeans The Heart Truths

Mortgage Rate Lock When Do I Lock In My Interest Rate Nerdwallet

Mortgage Information Amy Hadikin Royal Lepage Parksville Qualicum Beach Realty

Questions To Ask A Mortgage Lender